The reported growth may be a consequence of the impact of various factors. The need to sell the company in the case of entities established by their owners in the 1990s, or simply about the desire to hand the business over to other professional hands and focus on other ventures, stands out as one of them. On the other hand, in the case of transactions where Polish entrepreneurs made the purchase, it can be concluded that acquiring other entities is an increasingly popular way to expand, both domestically and internationally.

It can also be hypothesised that Polish entrepreneurs are increasingly integrating themselves into the free market economy. By this I mean treating businesses as projects in which the owners engage for a dozen or more years, after which they sell the company to invest or engage in the development of further entities. This kind of thinking and approach to business, as opposed to the approach of developing the company from inception and continuous improvement throughout the owner's career, is much more common in Western Europe.

We obtain an interesting comparison by comparing the number of transactions carried out in Poland and the Netherlands. Before we get to that, it is worth noting the basic parameters that characterise both economies:

- The GDP of the Netherlands is about 50% higher than that of Poland, according to official figures for 2021 (USD 1,013 billion account USD 679 billion)

- The population of the Netherlands is more than 2 times smaller than that of Poland (17.6 million versus 37.8 million)

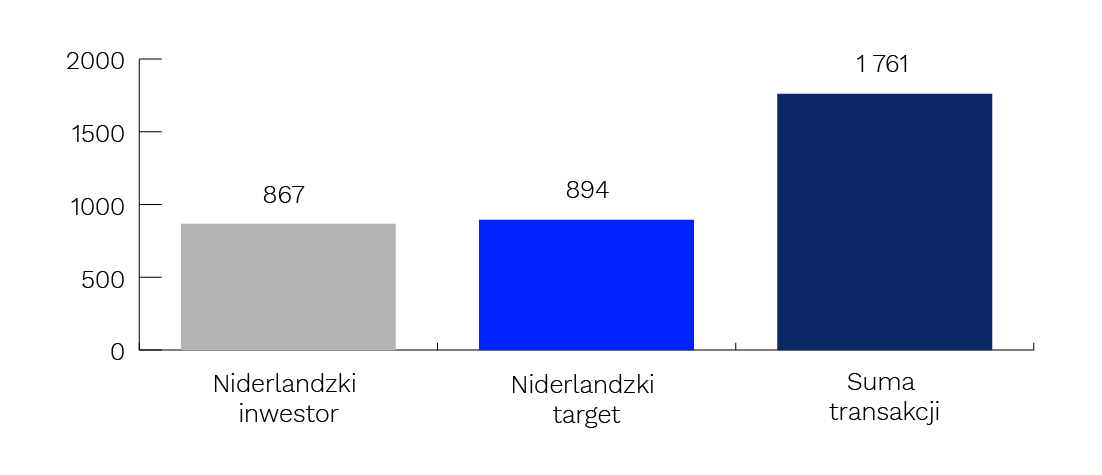

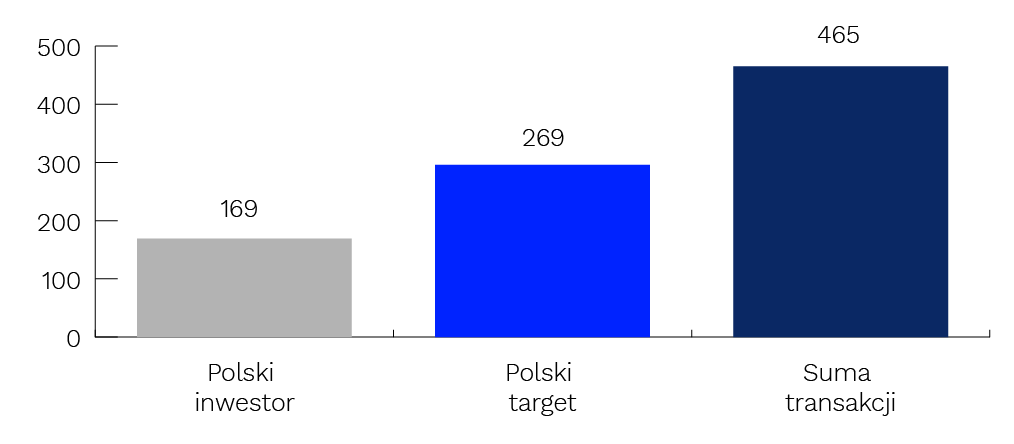

How does the number of transactions carried out in both countries compare to the above figures? In Poland, 465 transactions were recorded last year, while in the Netherlands there were a total of 1,761 acquisitions, almost four times as many. It is also worth noting the difference in the share of local investors in the total number of transactions in the two countries. In the Netherlands, half of all transactions were led by Dutch investors - 867 transactions, while in Poland local investors accounted for only 36%. The remaining number of transactions in our country concerned interest in Polish entities by foreign investors.

Figure 1: Number of transactions in the Netherlands in financial year 2022

Source: Own compilation based on data from MergerMarket

Chart 2. Number of transactions in Poland in financial year 2022

Source: Own compilation based on data from MergerMarket

It is worth considering what this contrast is due to. Undoubtedly, some connection can be found in the maturity of both economies and the age of Polish capitalism. In our country, takeovers are fortunately ceasing to be a taboo subject, a phrase with pejorative connotations and a synonym for failure.

From an advisory perspective, it is very positive that Polish entrepreneurs are increasingly thinking about looking for acquisition targets and see in acquisitions opportunities to accelerate the development of their business. An even more interesting trend I have observed is that Polish "champions", i.e. companies with Polish capital successfully operating on international markets, are thinking more and more often about acquiring companies on other markets.

A certain breath of fresh air can be seen from younger entrepreneurs, i.e. the generation of owners born in the 1970s and 1980s, not infrequently operating in the IT sector, which is characterised by a more liberal approach to doing business and establishing relationships between entrepreneurs. It is among these groups that one can often observe a lesser attachment to one's own business and a greater openness to establishing various capital relationships, as well as an approach to investing funds more freely in other entities. Over the next few years, the share of this group of entrepreneurs in the transaction market is likely to increase intensively, as the IT sector is one of those areas that are of greatest interest to investors.

At the end of last year, I had the pleasure, together with the M&A advisory team, of comprehensively supporting OptiBuy - an IT company specialising in increasing the purchasing efficiency of companies through the optimisation of internal processes - in the process of selling its shares to WNS - a leader among companies providing global business outsourcing services. This project perfectly demonstrates what the current trends in the transaction market are and what areas are of greatest interest to foreign investors focused on growth in the Polish market.

In summary, the transaction market in Poland is currently geared towards growth, as evidenced by the increasing number of mergers and acquisitions. Over the next few years, major changes are forecast in this area, primarily related to the new approach of Polish entrepreneurs to transactions - they are beginning to perceive acquisitions as an opportunity for business development and the possibility to quickly expand into foreign markets.

In 2023, we can expect the trend related to investors' interest in IT entities to continue. This area is very attractive to them due to the high possibility of a quick return on investment, but also due to the very good recognition of Polish companies on the international arena. On the other hand, it should be borne in mind that the transaction market in Poland still significantly lags behind other markets (e.g. in Europe or the United States) in terms of the number of transactions carried out.